Middle Corridor

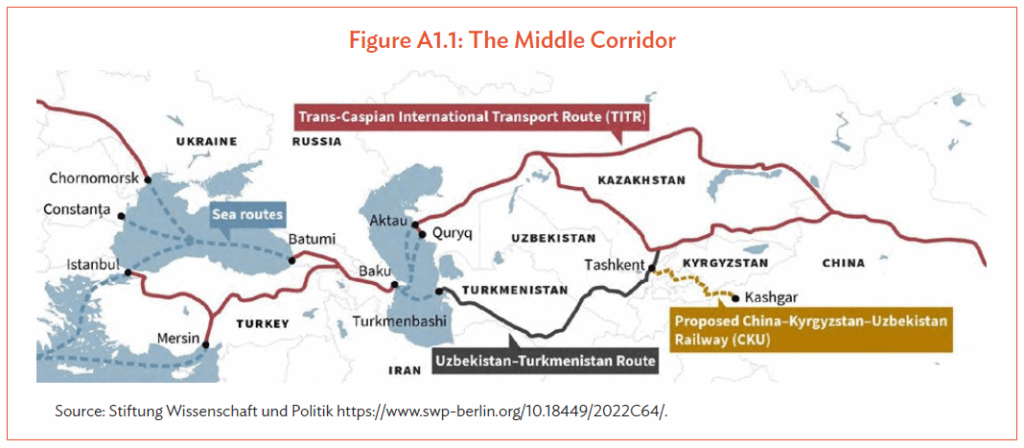

The Middle Corridor is a multimodal corridor that connects East Asia to Central Asia, Caucasus and Europe. There is a need to cross the Caspian Sea and possibly the Black Sea, using a road-water or railwater combination. This route does not traverse across Russian territory and has gained some popularity in 2022 when the Ukraine war began. The Middle Corridor is often used interchangeably with the term Trans-Caspian International Transport Route (TITR). For the CAREC context, the Middle Corridor can refer to two options. The first covers Kazakhstan to Azerbaijan to Georgia, crossing the Capsian Sea through either Aktau or Kuryk ports, and goes through Alat port in Baku. This is the popular option and promoted by the TITR Association where the founding members are the national railway companies, vessel operators and major logistics firms. The second option is the passageway from Turkmenistan to Azerbaijan to Georgia, using the Turkmenbashi port. As Turkmenistan has a stricter visa and transit regime, the first option is more popular especially amongst Turkish and Georgian transport operators.

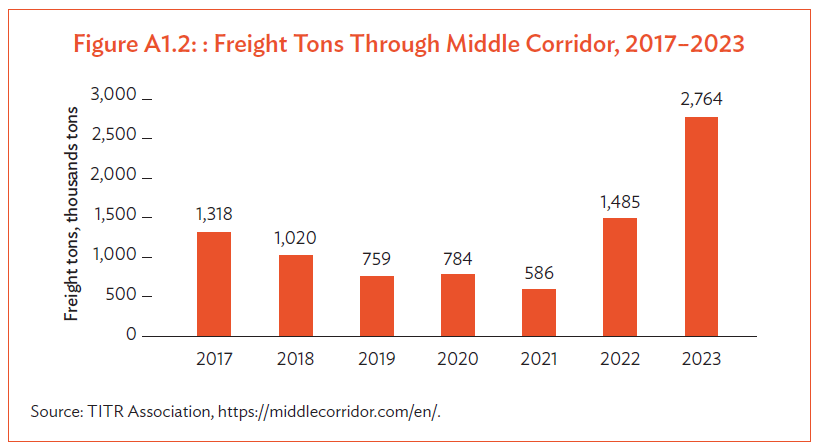

The year 2023 marked a significant uptick in cargo transportation along the Middle Corridor. Data from the Trans-Caspian International Transport Route Association indicates that over 2.7 million tons of cargo were transported, reflecting an 86% increase compared to the previous year. This surge underscores the corridor’s growing capacity and its escalating prominence as a conduit for transcontinental trade.

Azerbaijan, Georgia and Kazakhstan, as key stakeholders in the Middle Corridor, intensified their collaborative efforts in 2023. In April, these nations committed to fully leveraging the corridor’s capacity by implementing the 2022–2027 development roadmap. This strategic plan aims to eliminate infrastructural bottlenecks and enhance the corridor’s efficiency, thereby attracting increased international transit traffic.

Significant strides were made in modernizing the corridor’s infrastructure. In February 2023, the Kazakh government adopted a comprehensive strategy to develop its transport and logistics potential by 2030. This plan encompasses the enhancement of rail, road, maritime, and air transport modalities, with the Middle Corridor identified as a priority project. The initiative reflects Kazakhstan’s commitment to bolstering regional connectivity and facilitating seamless trade flows.

The Asian Development Bank (ADB) has provided a series of policy recommendations aimed at amplifying the Middle Corridor’s efficiency and economic impact. 1

- Harmonization of Cross-Border Procedures: Streamlining customs and border protocols across the corridor’s nations is essential to reduce transit times and operational costs. Standardizing these procedures can mitigate delays and enhance the corridor’s competitiveness.

- Public-Private Partnerships (PPPs): Mobilizing private sector investment through PPPs can address funding gaps in infrastructure development. Collaborative ventures can expedite project completion and introduce innovative solutions to logistical challenges.

- Digitalization of Logistics: Implementing advanced digital technologies, such as electronic data interchange systems and real-time tracking, can optimize supply chain management and improve transparency across the corridor.

- Sustainability Measures: Incorporating environmentally sustainable practices, including the adoption of green technologies and the reduction of carbon emissions, is crucial for the corridor’s long-term viability and alignment with global environmental standards.

- Capacity Building: Investing in human capital development through training programs can enhance the operational efficiency of the corridor. Building a skilled workforce is vital for managing complex logistics and adapting to evolving trade dynamics.

Challenges and Strategic Considerations

Despite the notable progress, the Middle Corridor faces several challenges that require strategic attention:

- Infrastructure Bottlenecks: Certain segments of the corridor, particularly maritime crossings like the Caspian Sea, experience capacity constraints. Expanding shipping capacity and modernizing port facilities are imperative to accommodate increasing cargo volumes.

- Regulatory Divergences: Disparities in regulations and standards among corridor countries can impede seamless transit. Establishing a unified regulatory framework is essential to facilitate smoother cross-border operations.

- Geopolitical Dynamics: The corridor traverses regions with complex geopolitical landscapes. Maintaining stability and fostering cooperative international relations are critical to ensure uninterrupted trade flows.

The developments in 2022 and 2023 have significantly enhanced the Middle Corridor’s capacity and efficiency, positioning it as a vital artery in Eurasian trade. Continued investment in infrastructure, harmonization of policies, and strategic collaborations are essential to sustain this momentum. By addressing existing challenges and implementing targeted policy recommendations, the Middle Corridor can realize its full potential, fostering economic growth and regional integration across the Caucasus and Central Asia.

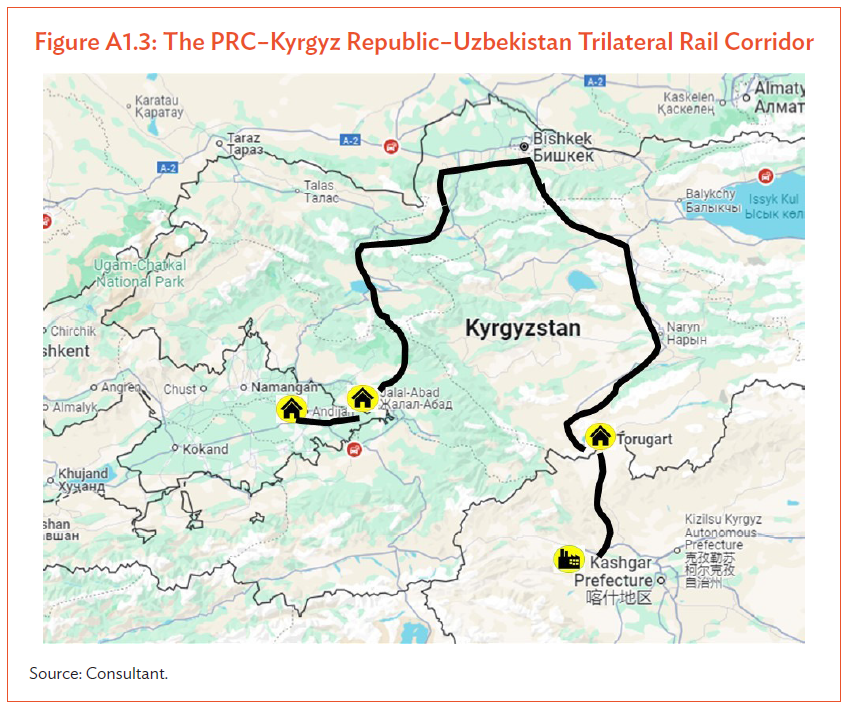

PRC–Kyrgyz Republic–Uzbekistan

The PRC, the Kyrgyz Republic, and Uzbekistan signed an agreement in December 2024 on a trilateral rail network that spans 486 km connecting Kashgar–Torugart–Makmal–Jalal–Abad–Andijan. This followed from another agreement signed between the three countries on 6 June 2024, and a joint railway company was established on 26 July 2024. PRC is the major shareholder of this joint company owning 51%, with the Kyrgyz Republic and Uzbekistan each owning 24.5%. The estimate cost of the construction is projected to be $4.6 billion. PRC will provision a loan to finance half of the estimated construction cost at $2.3 billion. The remaining half will be financed by the three countries according to the shareholding (PRC $1.2 billion, Kyrgyz Republic and Uzbekistan each $573 million). The design capacity of this railway is 12 million tons per annum.

Kashgar and Andijan are the start and end nodes in this corridor. Shipments will pass through two BCPs, Torugart (PRC–Kyrgyz Republic) and Jalalabad (Kyrgyz Republic–Uzbekistan). The majority of this section resides in Kyrgyz Republic, 311.75 km long in the entire 486 km of the railway. There will be 18 railway stations, 81 bridges with a total length of 26.1 km and 41 tunnels with a total length of 120.39 km.

The length of bridges and tunnels will be 146.49 km or 47% of the length of the section on the territory of the Kyrgyz Republic.

This trilateral rail corridor is strategic for PRC and Central Asia. For PRC, it is able to channel a new corridor that connects to the fertile Fergana Valley and access economic centers such as Samarkand and Bukhara. Traditionally, the only way to access these markets is to use road transport, or the railway through Kazakhstan. For the Central Asian Republics, this allows them to tap upon the vast transport network in PRC. Kashgar is the terminus for China Railway. By establishing a link between Andijan and Kashgar, the producers and exporters in the greater Fergana Valley (that covers Kyrgyz Republic, Tajikistan and Uzbekistan) can be served with a cost-effective rail option and move the products through trains across PRC and exports to markets such as East Asia and Southeast Asia.

Pakistan–Afghanistan–Uzbekistan

In February 2021, Pakistan, Afghanistan and Uzbekistan agreed a strategic plan to build a new 573 km railway across Afghanistan to connect Central Asia with ports in Pakistan on the Arabian Sea, estimated to cost $4.8 billion and running from Uzbekistan’s capital Tashkent via Kabul to Peshawar in Pakistan.

On 18 July 2023, the three countries signed a joint protocol to connect the Uzbek rail network with Pakistan Railway. The route for this connection will pass through Termez in Uzbekistan, Mazar-i-Sharif and Logar in Afghanistan, and culminate in Pakistan via the Torkham border crossing. The line will support both passenger and freight services and would contribute in regional trade and economic growth. 2

The new railway is expected to be completed by the end of 2027 and could carry up to 15 million tons of freight a year by 2030. The 760 km line would run from Termiz in Uzbekistan, via Mazar-e-Sharif and Logar in Afghanistan, to Kharlachi located near to the border.

This corridor has the potential to be a strategic game-changer for landlocked CAREC members. This is because the ports in Pakistan is the shortest route for Central Asian Republics to access international maritime trade lanes. By facilitating a rail corridor, shipments from Central Asia can use Karachi, Port Qasim or Gwadar to transport their goods to international markets. This route is also effective for accessing the lucrative markets in Middle East. For Central Asia, using the above-named ports is the most efficient. This is because connecting to the ports in the east in PRC is too far away (more than 4,000 km) and using the ports to the west in Georgia has limited connections and need to cross the Black Sea, which has constraints due to congestion at the Bosphorus Strait.

Shymkent–Tashkent–Khujand Economic Corridor (STKEC)

The Shymkent city (in Kazakhstan), Tashkent city (in Uzbekistan), and Khujand city (in Tajikistan) and their surrounding oblasts of Turkestan, Tashkent, and Sughd are strategically located within Central Asia and host 15% of the total population of the region. The countries are rich in core materials such as oil, gas, and uranium. The three STKEC member countries are also important from the perspectives of trade ties, energy, and multilateral cooperation with other countries around the world. In particular, the trade volume between the three countries have expanded rapidly in recent years. ADB supported the requests of Kazakhstan, Tajikistan and Uzbekistan to develop a corridor that covers the three cities and tap on synergistic elements to boost local production and cross-border trade.

In December 2022, the Governments of Kazakhstan and Uzbekistan signed a framework agreement on the establishment of the International Centre for Industrial Cooperation (ICIC). In March 2023, the parties chose a location for the ICIC near the Atameken-Gulistan BCP.15 Each country allocated 50 hectares of land for the ICIC from each side of the border. Subsequently, the governments also agreed on a list of priority industries for the ICIC and identified 63 joint projects to be implemented in the ICIC. The list of priority industries includes food, textile, and pharmaceutical industries.16

For Tajikistan, the plan is to develop a modern Trade and Logistics Center in Khujand. This center will serve the regional needs of the Sugd oblast as well as freight traffic with Kazakhstan and Uzbekistan

Almaty–Bishkek Economic Corridor (ABEC)

Almaty and Bishkek are two economic centers in CAREC region. The distance between the two cities is only 236 km, and the journey could be completed in four hours of driving. The Almaty–Bishkek Economic Corridor (ABEC) is a pilot economic corridor under the Central Asia Regional Economic Cooperation (CAREC) program. ADB serves as the secretariat for the CAREC Program and ABEC Initiative. Implementing an economic corridor between Almaty, Bishkek, and the surrounding regions since 2014, ABEC seeks to connect people, businesses, and ideas to shorten economic distance between the two cities of Almaty and Bishkek. This means reducing travel times; creating one competitive market for health, education, and tourism services; and aggregate agricultural produce in wholesale markets.

The vision of the economic corridor is that the two cities and its surrounding regions can achieve far more together than either can achieve alone. ABEC is guided by the Intergovernmental Council, which is chaired by the two Prime Ministers of the Kyrgyz Republic and Kazakhstan. The Council created the ABEC Subcommittee, a regular official meeting of the two national governments, regional governments, and private sector representatives, which is co-chaired by the Kazakh vice-minister of National Economy and the Kyrgyz deputy minister of Economy and Finance.

On 16–17 February 2023, more than 50 representatives from the governments of Kazakhstan and the Kyrgyz Republic met in Bishkek. CWRD DG E. Zhukov joined the meeting that was co-chaired by Deputy Minister of Economy and Commerce of the Kyrgyz Republic Kanatbek Abdrakhmanov and Vice-Minister of National Economy of Kazakhstan Abzal Abdikarimov. Both countries recorded their agreements in a signed protocol.

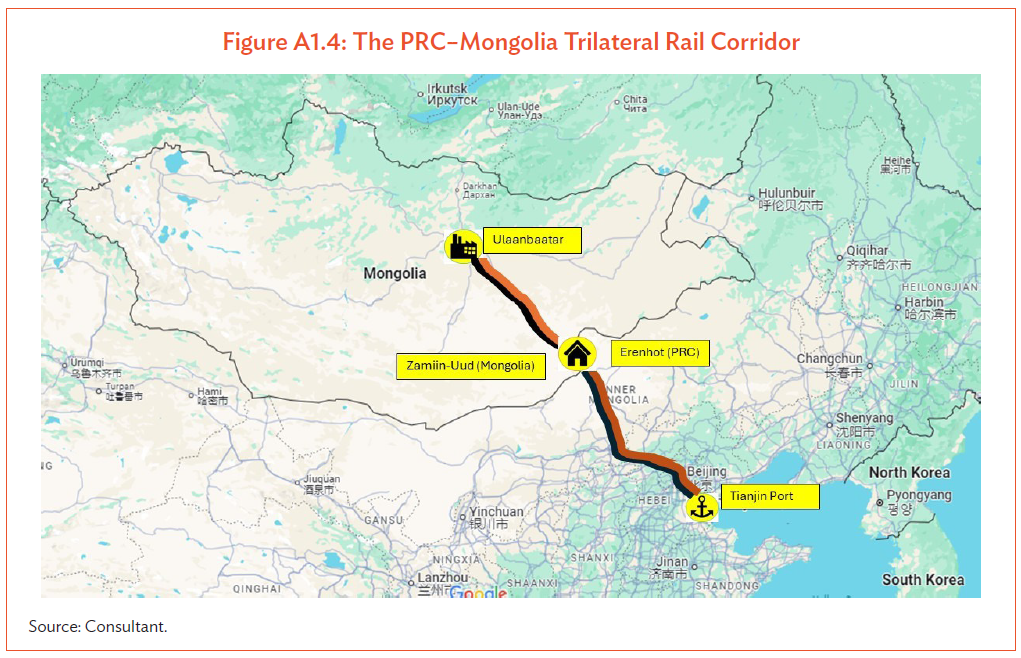

PRC–Mongolia

Under the Convention on Transit Trade of Land-locked States (1965), Mongolia as a landlocked country enjoys the right to access a seaport for transit trade.17 Since Mongolia only has two neighbor countries, the preference is to use PRC ports in the south, rather than the Russian ports in the north. This is because the Chinese ports are nearer to Mongolia, and they can operate in winter with less problems from the freezing of the sea waters. Tianjin is the most popular port for Mongolia and is 980 km to Zamiin Uud, and 1,700 km to Ulaanbaatar. Railway is the preferred option to transport imports and exports between Ulaanbaatar and Tianjin. It is also possible to transport goods by trucks, and the Zamiin-Uud and Erenhot BCPs serve both rail and road transport. However, road transport is more expensive. A rail shipment from Tianjin to Ulaanbaatar typically takes 10 to 14 days in one direction. As PRC and Mongolia use different rail gauge standards, the trains must stop at the border for change of gauge operation, before continuing to the final destination.

Since 2023, shipment time along this route gradually increased to three months, an unbearably long

duration. The problem was attributed to the bottleneck and Zamiin-Uud and Ulaanbaatar. While Tianjin port has the capacity to process 45 trains per day, and Erenhot 20 days per day, the Zamiin-Uud BCP is only able to handle 7 trains per day. Furthermore, priority is given to transit trains that move to the Russian Federation and Europe. The problem is further compounded by the low productivity at Ulaanbaatar, where there are 14 stations that handle the incoming goods but are using ageing equipment and cranes that can only unload 1 to 2 trains per day at each station.

The situation has created a demand for road transport, where Mongolian consignees resorted to the use

of trucks to collect the pending goods in Tianjin port, and send them to the BCPs. Zamiin-Uud has a

newly modernized zone for processing road shipments, financed by the PRC. The use of road transport is

expensive but greatly shortens the delivery time.

China Block Trains

The China–Europe container block train initiative—branded as China Railway Express (CRE), has emerged as a key overland trade artery between East Asia and Europe, offering a faster alternative to maritime transport. It plays an increasingly strategic role for CAREC countries, with several border-crossing points (BCPs) such as Alashankou, Dostyk, Khorgos, and Altynkol serving as critical gateways. These trains link over 110 Chinese cities with 200 cities across 25 European countries.

In 2023, the CRE program recorded 17,523 block trains transporting approximately 1.9 million TEUs, registering a 6% increase in train frequency and 5% growth in container volume compared to 2022. While geopolitical uncertainties in Eastern Europe and reduced post-COVID demand slightly tempered earlier exponential growth, the network remains a resilient and essential logistics channel.

The outbound trains from PRC primarily carry electronics, machinery, garments, and consumer goods, while inbound trains to PRC deliver automotive parts, wines, dairy, and industrial equipment.

The container trains experienced delays at transshipment points due to gauge change operations, especially at Dostyk/Altynkol (Kazakhstan) and Brest/Malaszewicze (Belarus/Poland). These processes typically add 24–48 hours to total transit time. Additionally, disparities in customs clearance procedures and limited adoption of electronic data interchange (EDI) across borders hinder real-time cargo tracking and contribute to inefficiencies.

Table A1.1: Different Routes of the China Rail Express (CRE)

| Route | Description | Key Border Points | Average Transit Time |

|---|---|---|---|

| Northern Route | Via Mongolia and Russia to Belarus and Poland | Erenhot–Naushki, Manzhouli–Zabaykalsk | 16–18 days |

| Middle Route | Via Kazakhstan and Russia, often using Dostyk or Alashankou | Alashankou–Dostyk, Khorgos–Altynkol | 14–16 days |

| Southern Route | Via Kazakhstan, Caspian Sea, and Türkiye using the Middle Corridor (TITR) | Khorgos–Aktau, BTK Railway | 15–17 days |

From a policy perspective, several considerations are highlighted for CAREC member governments and development partners:

- Infrastructure Modernization: Continued investment is needed at major BCPs (e.g., Khorgos, Dostyk, Altynkol) to expand border-crossing capacity, shorten change of gauge duration, and reduce rail congestion.

- Digital Trade Facilitation: Adoption of harmonized customs documentation, pre-arrival processing, and rail cargo tracking platforms will reduce administrative delays and improve cargo throughput.

- Sustainable Logistics Development: CRE offers a low-emissions alternative to maritime transport. Supportive policy instruments—such as carbon pricing incentives and green logistics zones—can reinforce this advantage.

- Diversification via Southern Corridors: To improve resilience, member states should develop alternative multimodal corridors, particularly along the Middle Corridor and through Türkiye, to supplement Northern Route dependence.

In 2023, PRC authorities continued to subsidize inland dry ports (e.g., Xi’an, Chengdu, Zhengzhou), while European partners increasingly encouraged backhaul flows to improve train balance. These dynamics reflect the CRE’s role not only as a trade conduit but as a lever for regional economic integration and supply chain resilience.

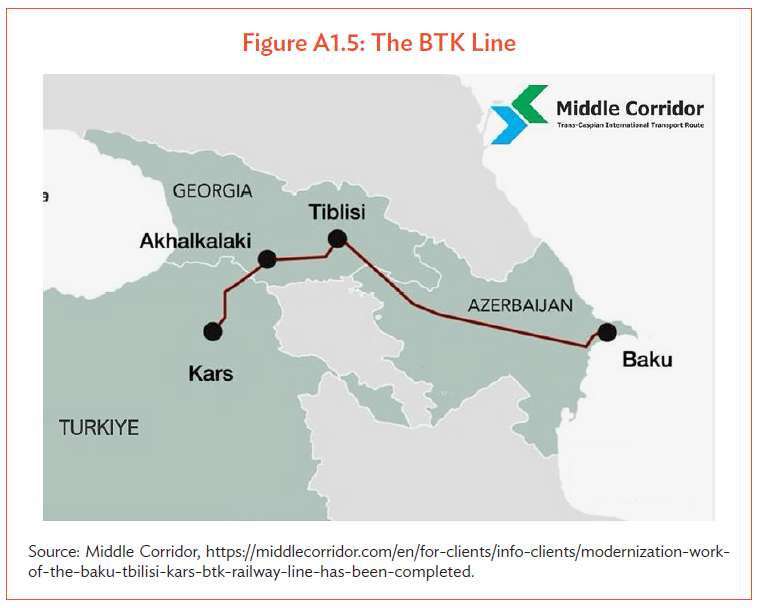

Baku–Tbilisi–Kars (BTK)

The Baku–Tbilisi–Kars (BTK) railway is a strategic rail corridor linking the South Caucasus and Türkiye, offering a direct overland route between Central Asia, the Caspian Sea region, and Europe without transiting through Russian territory. It is a vital segment of the Middle Corridor (Trans-Caspian International Transport Route, TITR) and provides an alternative connection for container block trains and bulk cargo shipments moving between the People’s Republic of China (PRC) and European markets. The BTK line spans 826 kilometers, connecting the Port of Alat (Baku) in Azerbaijan through Tbilisi and Akhalkalaki in Georgia to Kars in Türkiye.

Of the total length, 504 km lies in Azerbaijan, 263 km in Georgia, and 59 km in Türkiye. The line uses standard gauge (1,435 mm) from Kars to Akhalkalaki, where a gauge change terminal facilitates interoperability with the broad-gauge (1,520 mm) systems of Azerbaijan and other former Soviet republics. Originally inaugurated in 2017, the BTK line was temporarily suspended in 2023 for major renovation and expansion work—particularly at Akhalkalaki station and along a 184-km stretch in southern Georgia. Full service resumed in May 2024, restoring freight movement and enhancing overall corridor capacity.

Table A1.2: Specifications of the Baku–Tbilisi–Kars (BTK) Line

| Length | 826 km (504 AZE, 263 GEO, 59 TUR) |

| Gauge Interchange | Akhalkalaki (1520 mm ↔ 1435 mm) |

| Capacity (Design) | 5–6 million tons per year (target: 17 million) |

| 2022 Freight Volume (pre-renovation) | Approximately 1.0 million tons |

| Target Transit Time (China–Europe) | 12–15 days |

Source: Compiled by the Consultant.

The BTK serves both bulk and container traffic, including metals, construction materials, machinery, and food products. The railway reduces transit times from 30 to 45 days by sea to under 15 days via rail, enhancing competitiveness for time-sensitive and higher-value goods.

From a policy and investment perspective, the BTK’s strategic benefits are manifold:

- Geopolitical Diversification: BTK offers an essential bypass of congested or politically sensitive routes (e.g., Northern Corridor via Russia and Belarus), especially relevant following the Ukraine conflict.

- Seamless Multimodal Linkage: The BTK complements Caspian ferry services (Aktau/Kuryk to Baku), enabling multimodal combinations that support East–West freight flows through landlocked Central Asia.

- Regional Integration and Trade Facilitation: The railway strengthens trilateral cooperation among Azerbaijan, Georgia, and Türkiye, and enhances market access for landlocked CAREC economies.

However, challenges remain. The gauge break at Akhalkalaki and the limited wagon exchange capacity continue to constrain throughput. Moreover, customs clearance is not yet harmonized across all three countries, and digital cargo tracking is still under development.

In 2023–2024, the governments of Azerbaijan, Georgia, and Türkiye, with support from international partners, invested over $100 million in BTK rehabilitation, focusing on:

- Railbed strengthening and slope stabilization

- Signal and communication systems upgrades

- Expansion of cargo handling facilities in Akhalkalaki and Kars

For CAREC policymakers, the BTK represents a priority corridor to support East–West trade connectivity. Policy actions to maximize the corridor’s potential include:

- Harmonizing customs and transit procedures, possibly through a single window or unified transit regime

- Investing in logistics hubs and dry ports near Akhalkalaki and Kars

- Expanding containerization and multimodal service offerings, including temperature-controlled and fast-track rail services

- Promoting public–private partnerships (PPP) to improve commercial viability and attract freight operators

When the service is fully restored, the BTK is expected to handle up to 5 million tons of cargo annually by 2025, with future upgrades targeting a capacity of 17 million tons per year. As global supply chains recalibrate, BTK has the potential to extend the Middle Corridor, bridging Central Asia to Europe more efficiently and securely.

- ADB, The Middle Corridor offers new opportunities and challenges for transport through the Caucasus and Central Asia, https://www.adb.org/

publications/unlocking-transport-connectivity-in-the-caucasus-and-central-asia. ↩︎ - Ministry of Information and Broadcasting (Pakistan), https://www.moib.gov.pk/News/54669. ↩︎