The CPMM analysis relies on consistent and comparable data across CAREC countries, despite their inherent differences. This chapter provides an update of the main developments and CPMM data at a national level for each CAREC member country to help explain the trends or resulting outcomes at the regional or corridor level. This country-level analysis examines the policies, regulations, infrastructure, and institutional factors that can affect corridor performance. Pertinent barriers and issues are highlighted, key developments and progress are noted, and high-level recommendations are included.

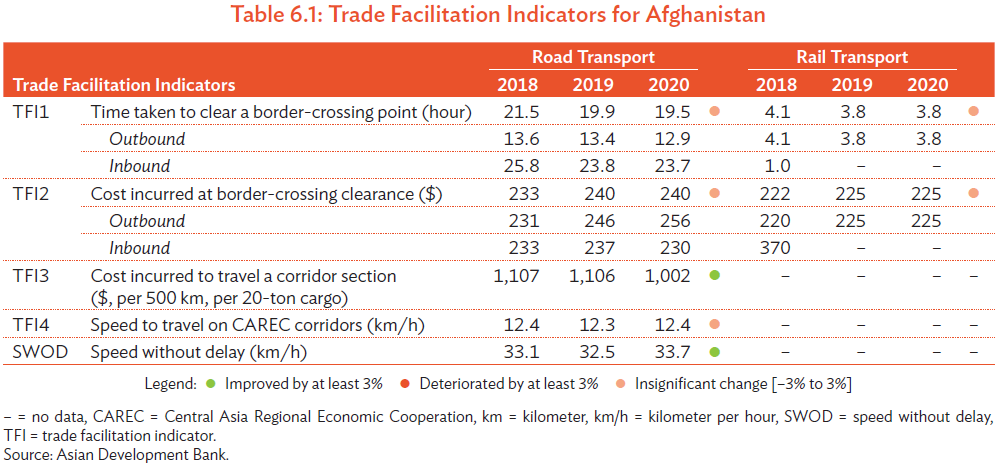

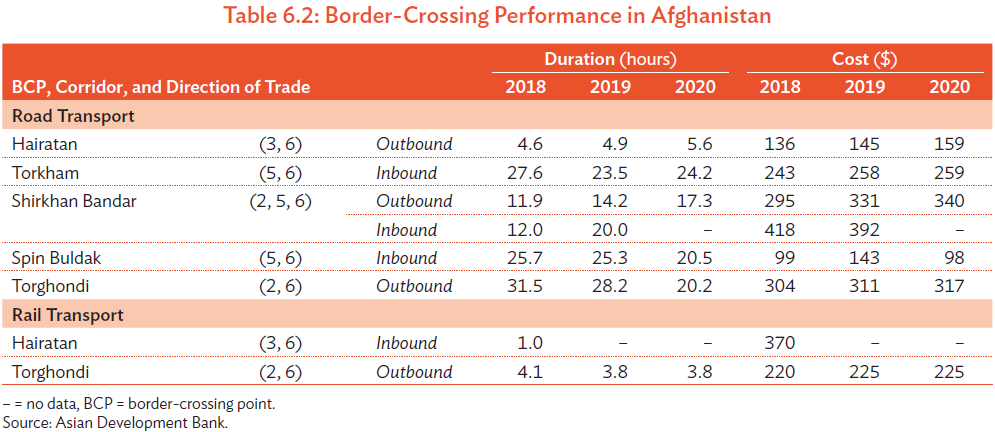

The 2020 CPMM report introduces the four TFIs at the country level, segregated by road and rail transport, and further separated into outbound and inbound direction for border-crossing time and costs (Tables 6.1–6.22). These data are supplemented by average border-crossing time and cost for BCPs along relevant CAREC corridors. Key CPMM findings, updated trends and developments, and country-specific recommendations are also provided in this chapter.

Key Findings

- Despite the COVID-19 pandemic, border-crossing performance for road transport was comparatively unchanged compared to 2019. Border-crossing time was recorded at 19.9 hours in 2019, and 19.5 hours in 2020.

- For 2019 and 2020, border-crossing cost was $240. Total transport cost was $1,106 in 2019, and $1,002 in 2020.

- SWOD was 33.7 km/h, while SWD was 12.4 km/h—which remained lowest in the region.

- Torkham reported the most significant delay averaging 24.2 hours in 2020, followed by Spin Buldak at 20.2 hours, and Shirkhan Bandar at 17.3 hours.

- The magnitude of the border-crossing time and cost, as well as the total transport cost, continued to remain at elevated levels compared to other BCPs in the region. Security remained a prime concern, which increased the cost of shipment, as well as unofficial fees imposed on shippers and transport operators.

Trends and Developments

Afghanistan was actively developing transit corridors and has engaged neighbour countries to conclude bilateral or multilateral agreements. The involvement and signing of some key agreements have hinted at the growing confidence of neighboring countries in the development and prospects of Afghanistan. The developments in railways have been particularly encouraging. For instance, Afghanistan, Pakistan, and Uzbekistan have discussed the feasibility of a 573-km line connecting Mazar-i-Sharif–Kabul–Peshawar. The route passes through the Hindu–Kush mountainous terrain with an altitude of 3,500 m. Afghanistan has confirmed the adoption of 1,435 mm standard gauge, which implies double gauge change operations since Uzbekistan uses 1,520 mm and Pakistan uses 1,676 mm gauge.

The Turkmenistan–Afghanistan–Tajikistan 400-km railway project which began in 2013, shows steady progress. Turkmenistan has completed the sections at Atamyrat (now called Kerki), Ymamazar, and Aqina (that lies at the Afghan border). In addition, Turkmenistan has provided technical and financial assistance to Afghanistan for the railway construction within Afghanistan territory. Afghanistan and Turkmenistan have jointly launched the 30-km railway link between Aqina and Andkhoy, extending railway connectivity

to inland cities.

Besides land transport, the country is also actively pushing for other modes of connectivity. The Turkmenistan–Afghanistan–Pakistan–India pipeline was progressing, although it was hampered by security concerns over Taliban-held areas in the northwestern region of the country. This project would balance the supply of energy from surplus in Turkmenistan to deficit areas in India and Pakistan. The seaport project at Chabahar is a trilateral cooperation between Afghanistan, India, and Iran to add an option on top of Pakistan seaports. On the aviation front, Afghanistan launched the National Air Corridor Program that flew Afghan exports such as agricultural products and carpets to international markets such as Mumbai, New Delhi, and Istanbul. The new CAREC aviation strategy will be useful for the country to modernize airport infrastructure, strengthen regulatory and procedural controls, and build greater connectivity to international air hubs.

The country participates in the continuous dialogue on the Afghanistan–Pakistan Transit Trade Agreement (APTTA) 2010, a bilateral agreement between Afghanistan and Pakistan which resumed negotiations in 2019. Latest discussions also included the exploration of setting up border markets, an invitation to Afghanistan to participate in the China–Pakistan Economic Corridor (CPEC), as well anticorruption measures along the transit routes.

Recommendations

- Conclude Afghanistan–Pakistan Transit Trade Agreement negotiation with Pakistan

authorities. This is to resolve the remaining issues on transit trade—a cornerstone for other transit trade that could attract other CAREC members. - Begin development of an authorized economic operators system. As reported in the 2019 annual report, an effective authorized economic operators (AEO) system would increase confidence in the trade community. Currently, there is a high distrust of traders due to smuggling concerns which has led to multiple and repeated physical examinations at land BCPs and airports. The legal framework, operational procedure, and use of digital tools would be instrumental to kick-start an AEO system that would improve border-crossing efficiency at least for a selected group of exporters and transport operators. Considering that Pakistan has started an AEO system, it would be positive for both Afghanistan and Pakistan to include this in the APTTA and explore the interoperability of the AEO standards.

- Implement the Transports Internationaux Routiers (International Road Transports). The TIR was reactivated in September 2013. While there were efforts to promote the TIR, its level of usage has remained low—as there were only 100 TIR Carnets purchased from the International Road Transport Union (IRU) in 2018, and 200 in 2019.25 The difficulty of obtaining road passes and visas, even for TIR Carnet holders, discouraged the extensive use of TIR. The Ministry of Foreign Affairs would need to coordinate these with the foreign counterparts and consider simplified schemes for AEOs, for example, to operationalize greater use of TIR.

- Accede to the Convention on the Contract for the International Carriage of Goods by Road. Private shippers and transport operators in Afghanistan typically have low proficiency and access to risk mitigation tools such as transport insurance. Thus, when there are losses or damages, the shipper, consignee, and transport operator could be drawn into an excessively long dispute. The Convention on the Contract for the International Carriage of Goods by Road (CMR) complements the TIR Convention and provides insurance coverage for road transport operators. All CAREC member countries except for Afghanistan and the PRC are signatories of this agreement. Accession to the CMR would help transport operators to utilize insurance.

- Roll out 24/7 at other high-traffic border-crossing points. At Torkham, 24/7 operation was officially launched in September 2019. It was proven that this action had immediately and significantly shortened border-crossing time. This scheme could roll out to other high-traffic BCPs that had long border-crossing time, such as Spin Buldak and Shirkhan Bandar.

- Strengthen Afghanistan Railways Authority. The participation of Afghanistan in various railway projects requires a skilled workforce and policy makers in railway transport. World Bank strengthened the capacity of Afghanistan Railways Authority (AfRA). Technical personnel from Uzbekistan have also provided assistance in the past, and more recently, technical personnel from Turkmenistan. AfRA would need institutional capacity to handle the policies and the operations such as infrastructure, project financing, and management of rolling stocks.

- Strengthen Afghanistan Civil Aviation Authority. The air corridors remain an important outlet for shipping time-sensitive products. This is especially important from April to November when fresh fruits such as cherries, grapes, and pomegranates are harvested and need to be exported quickly. The ability of policy makers and technical personnel to handle air shipments of vaccines is also essential in 2021.