The CPMM analysis relies on consistent and comparable data across CAREC countries, despite their inherent differences. This chapter provides an update of the main developments and CPMM data at a national level for each CAREC member country to help explain the trends or resulting outcomes at the regional or corridor level. This country-level analysis examines the policies, regulations, infrastructure, and institutional factors that can affect corridor performance. Pertinent barriers and issues are highlighted, key developments and progress are noted, and high-level recommendations are included.

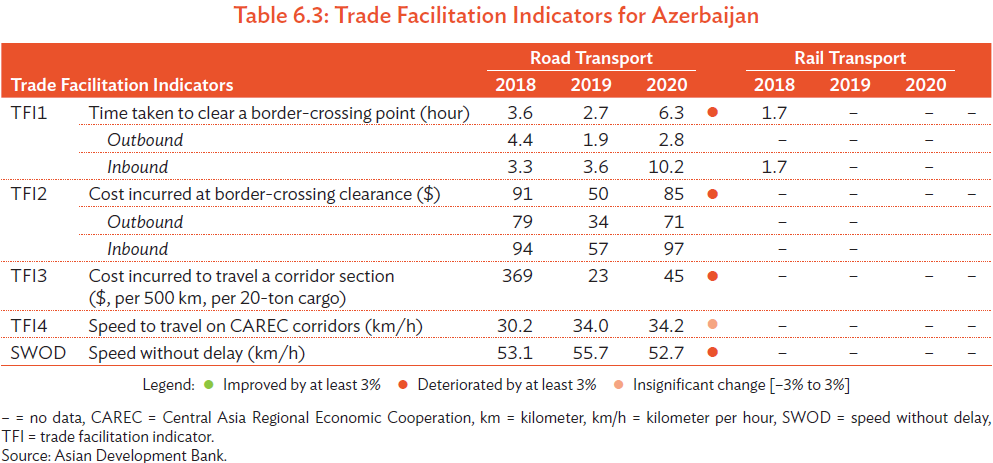

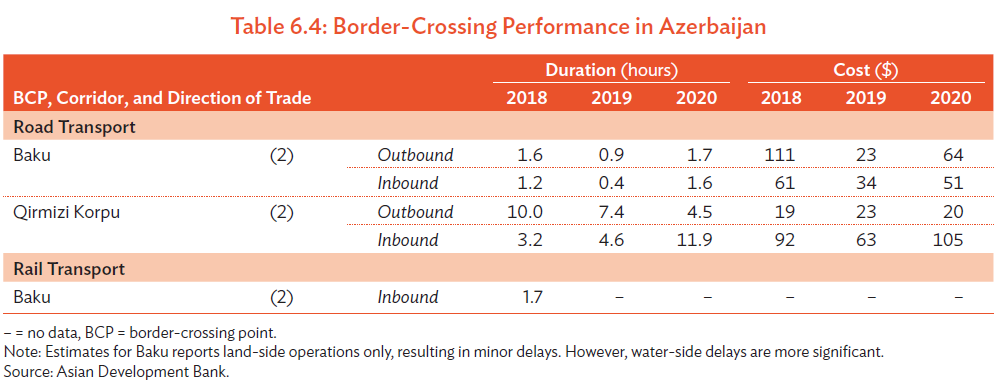

The 2020 CPMM report introduces the four TFIs at the country level, segregated by road and rail transport, and further separated into outbound and inbound direction for border-crossing time and costs (Tables 6.1–6.22). These data are supplemented by average border-crossing time and cost for BCPs along relevant CAREC corridors. Key CPMM findings, updated trends and developments, and country-specific recommendations are also provided in this chapter.

Key Findings

- Border-crossing performance showed a sharp rise in terms of duration and fees, as well as total transport cost. Border-crossing time in 2020 for trucks shot up from 2.7 hours in 2019 to 6.3 hours in 2020, due to longer inbound examinations.

- Border-crossing cost also increased from $50 in 2019 to $85 in 2020. Total transport cost increased from $23 in 2019 to $45 in 2020.

- SWOD slowed slightly to 52.7 km/h, while SWD remained relatively unchanged at 34.2 km/h compared to 2019.

- Qirmizi Korpu (Red Bridge) reported the most significant delays averaging 11.9 hours in 2020 (inbound traffic).

Recommendations

- Develop a logistics park. A logistics park is a zone where the facilities and services are provided to improve supply chain efficiency. A manufacturer could outsource the storage, transportation, and packaging operations to a logistics service provider. For this reason, a logistics park is commonly located adjacent or within a special economic zone.

- Develop a container freight station. The country lacks a network of modern container freight stations (CFS). A CFS is a facility that consolidates loose cargoes into a container or deconsolidates the cargo for collection. This is normally done under customs supervision and is a cost-effective way for shippers to use containerization and to sends goods to their final destination. Kazakhstan has expressed interest and optimism in the growth of container traffic especially in the transit business in the Caspian region, so demand for CFS could be substantial.

- Encourage the formation of a freight forwarding association. While Azerbaijan has a national road carrier association that serves as the national TIR association, there is no national freight forwarders association. As such, the country does not have representation in the International Federation of Freight Forwarders Association (FIATA). Having a national freight forwarding association would help develop a service subsector that offers specialized planning and execution for exporters and importers.

- Participate in Corridor Performance Measurement and Monitoring studies. Previously, the Azerbaijan national TIR association Azerbaijan International Road Carriers Association (ABADA) participated in CPMM studies. However, it did not continue after the early years, citing the low traffic to Central Asia. With the developments in CAREC and the Caspian Sea, this could change. The national railways operator Azerbaijan Demir Yollari is also welcomed to participate in the CPMM studies so that rail samples could be collected.