CPMM samples comprise commercial shipments moving through Central Asia. Although most of these shipments originate or end in CAREC countries, some origins and destinations are located outside the region, such as the EU, Iran, the Russian Federation, and Türkiye.

Data Samples

A total of 2,420 samples were collected in 2023. Eleven partners (associations) participated in CPMM. These associations come from nine countries. There were no CPMM partners in Azerbaijan and Turkmenistan. The performance of these two countries was analyzed by transit shipments from other CPMM partners that shipped through these two countries.

Table 5.1: CPMM Partners

| Country | Association | Abbreviation | |

|---|---|---|---|

| 1 | Afghanistan | Association of Afghanistan Freight Forwarding Companies | AAFFCO |

| 2 | PRC | Xinjiang Uygur Autonomous Region Logistics Association | XULA |

| 3 | Georgia | Georgia International Road Carriers Association | GIRCA |

| 4 | Kazakhstan | Association of National Freight Forwarders of the Republic of Kazakhstan | KFFA |

| 5 | Kyrgyz Republic | Freight Operators Association | FOA |

| 6 | Mongolia | Mongolia Chamber of Commerce and Industry | MNCCI |

| 7 | Mongolia | National Road Transport Association of Mongolia | NARTAM |

| 8 | Pakistan | Pakistan International Freight Forwarders Association | PIFFA |

| 9 | Tajikistan | Association of Road Transport Operators of Republic of Tajikistan | ABBAT |

| 10 | Uzbekistan | Association for Development of Business Logistics | ADBL |

| 11 | Uzbekistan | Association of International Road Carriers of Uzbekistan | AIRCUZ |

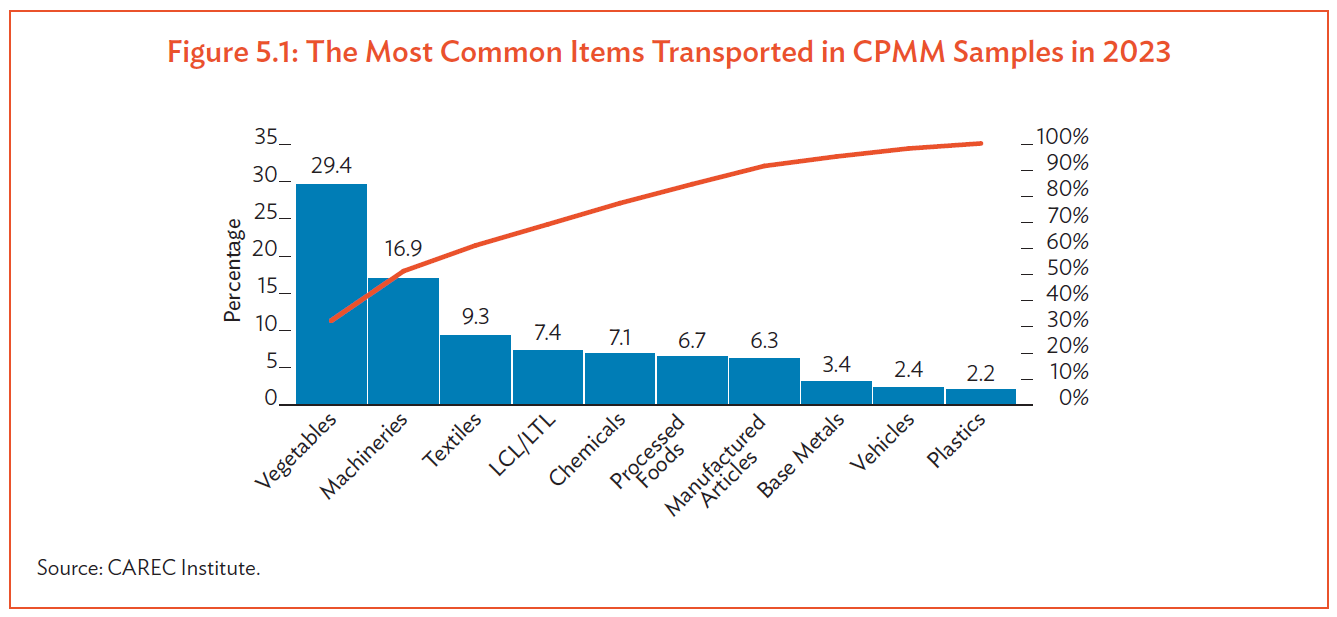

Shipments studied in CPMM showed a wide variety of merchandise being transported. The top 10 items accounted for 91% of all merchandise. Vegetables was the top-ranking category (29.4%), followed by machineries (16.9%) and textiles (9.3%). LCL (less than a container load) or LTL (less than a truck load) represented assortment items, where the train or truck carried mixed goods, unlike the first three categories where only one product type was carried. Chemicals (7.1%), processed foods (6.7%), manufactured items (5.3%), base metals (3.4%), vehicles (2.4%) and plastics (2.2%) completed the top 10 products list.

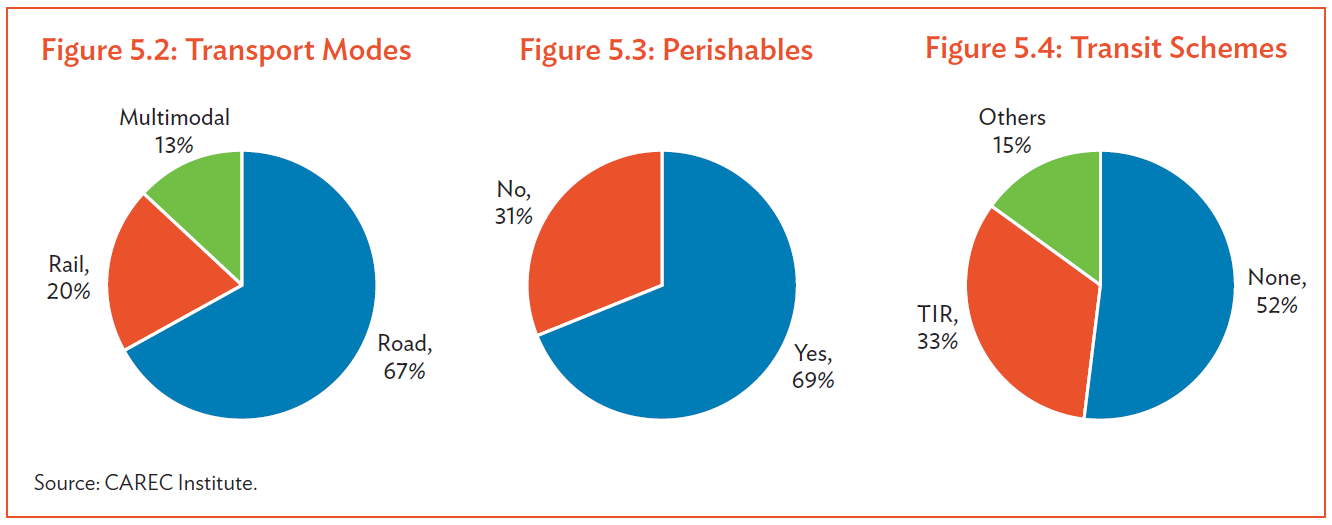

CPMM samples contained mainly road transport, contributing two-thirds of all samples. Rail transport contributed another 20%. Multimodal shipments formed the remaining 13%. Perishables shipments accounted for 31% of all shipments. These were mainly sent on road transport. Shipments that used TIR accounted for one-third of all road samples.

Road Transport

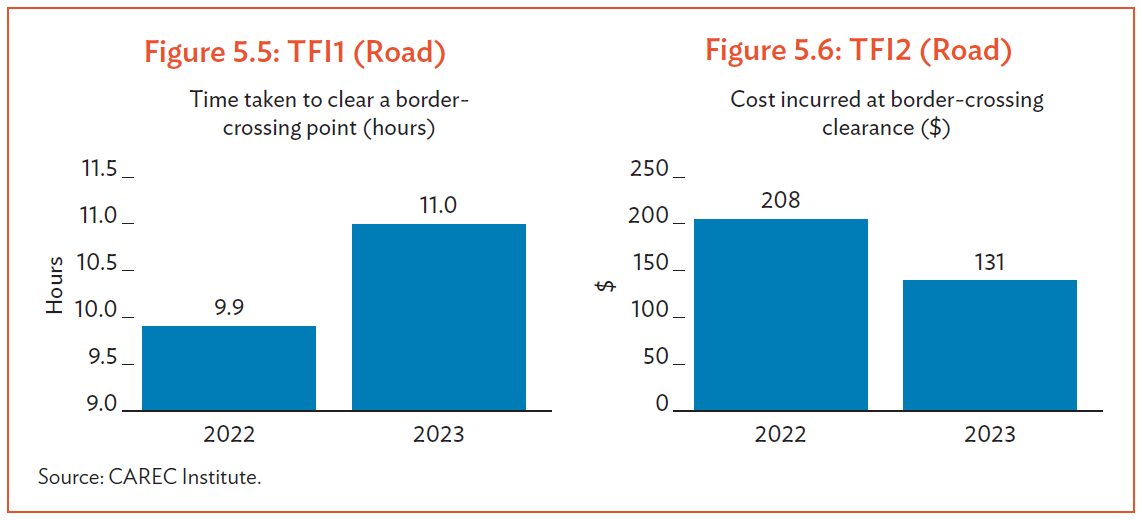

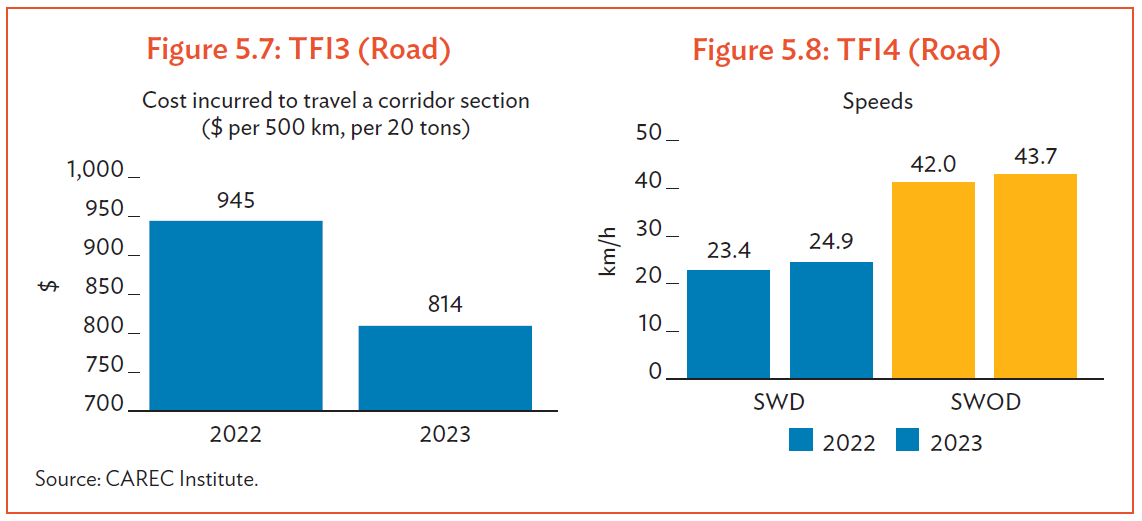

Road transport in terms of TFIs reported mixed performance in 2023 over the previous year. Average border-crossing time increased 11% to 11 hr, while average border-crossing cost decreased 37% to $131. Total shipment cost decreased 14% to $814. Both SWOD and SWD rose in 2023. TFI1 (road) reported an increase from 9.9 hr (2022) to 11.0 hr (2023). While the duration at Corridor 1 decreased, those at Corridor 2 and 5 increased, pushing up the average TFI1.•

- TFI1 for Corridor 2 rose from 7.5 hr to 10.4 hr. In the period 2022 to 2023, Tsiteli Khidi’s duration rose from 24.2 hr to 54.9 hr. Krasnyi Most’s duration increased from 13.6 hr to 16.5 hr.

- TFI1 at Corridor 5 rose from 18 hr to 22.9 hr due to the longer time taken at Torkham and Chaman–Spin Buldak. Torkham (Pakistan) reported an increase in time from 24.2 hr to 30.0 hr, Chaman from 54.0 hr to 48.3 hr and Spin Buldak from 7.6 hr to 10.7 hr.

TFI2 (road) reported a decrease from $208 (2022) to $131 (2023). This was led by the drop in the fee size at Corridor 1 from $1,107 to $347.

- Khorgos was the main reason for the cost reduction. The fee size decreased from $1,861 (2022) to $723 (2023) owing to lower loading and unloading costs. The relaxation of the strict epidemiological tests and the cargo transfer instituted in 2020 to 2022 to combat the COVID-19 pandemic contributed to the reduced cost of border-crossing.

TFI3 (road) reported a decrease from $945 (2022) to $814 (2023). This was led by the drop in the transport rate at Corridor 1 (from $2,387 to $1,517) and Corridor 4 (from $1,566 to $1,250).

- Corridor 1b showed the largest fee drop from $3,362 to $1,536. This implied that the road freight cost in the section from Urumqi to Almaty has decreased in 2023.

- Corridor 4a also showed a notable drop, from $2,732 to $1,292 in terms of the coal shipments from Mongolia’s western region to PRC, crossing Yarant–Takeshikent BCPs.

- Corridor 4b also showed some cost reduction, from $1,469 to $1,248. This corridor is a busy section of freight movements between Tianjin to Ulaanbaatar.

SWOD and SWD reported marginal improvement. In the period 2022 to 2023, SWOD increased from 42 km/h to 43.7 km/h, while SWD rose from 23.4 km/h to 24.9 km/h.

- For SWOD, Corridor 3 showed the best improvement, rising from 35.9 km/h to 55.0 km/h. Corridor 1 registered the fastest SWOD at 62 km/h, and Corridor 5 showed the slowest at 34.4 km/h.

- For SWD, Corridor 3 and 4 showed the best improvement. Corridor 3 moved up from 25.4 km/h to 37.6 km/h, while Corridor 4 from 27.6 km/h in 2022 to 36.5 km/h in 2023.

Rail Transport

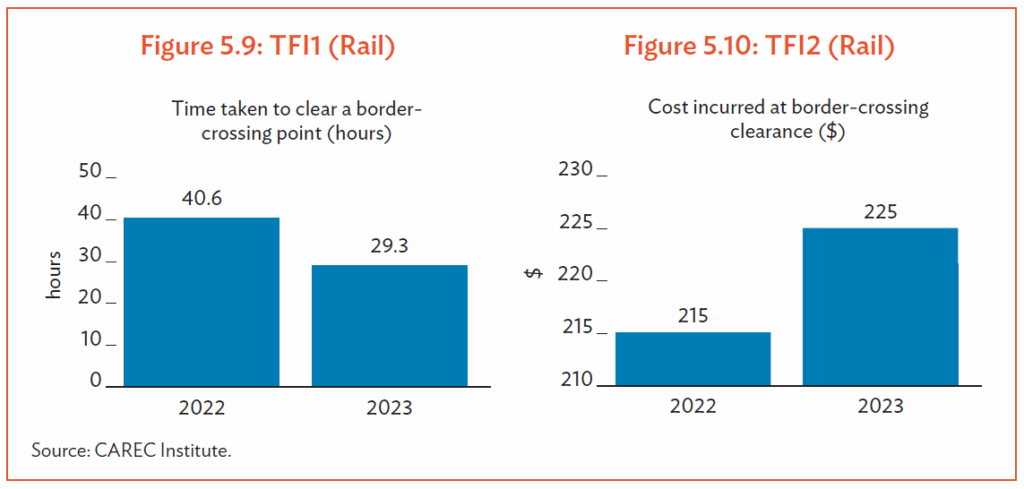

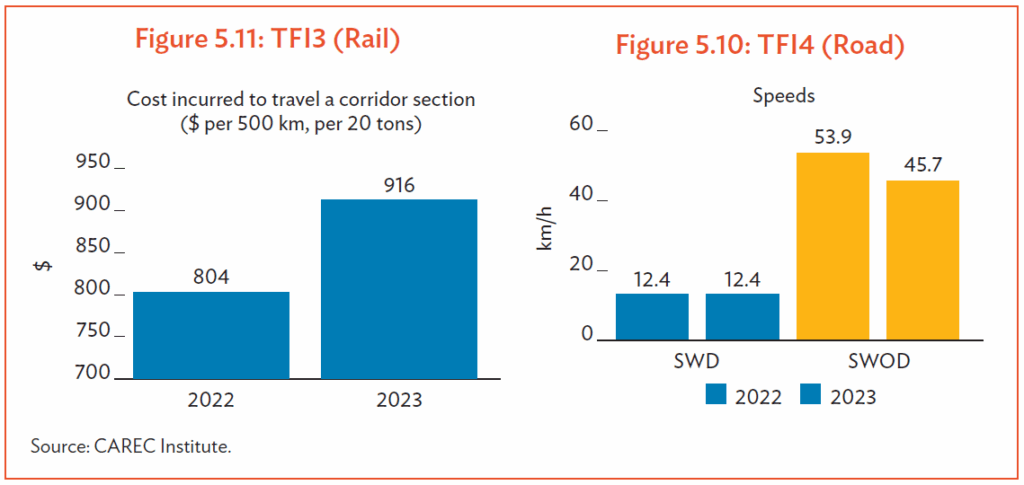

Rail transport TFIs reported mixed performance in 2023 over the previous year. Average border-crossing time decreased 28% to 29 hr, while average border-crossing cost increased 5% to $225. Total shipment cost increased 14% to $916. SWOD decreased while SWD remained the same.

TFI1 (rail) reported a decrease from 40.5 hr (2022) to 29.3 hr (2023). Both Corridors 1 and 4 showed improvement. The duration at Corridor 1 decreased from 52.1 hr (2022) to 43.0 hr (2023).

- This was led by the reduction of border-crossing time at Alashankou (30.5 hr to 17.5 hr) and Khorgos (34.8 hr to 12.5 hr) year on year.

- The duration at Corridor 4 decreased. This was an improvement due to Erenhot (44.4 hr to 5.3 hr) and Zamiin-Uud (20.1 hr to 6.3 hr) in the outbound direction.

- In the inbound direction, Erenhot also shrunk from 54.9 hr to 16.3 hr).

- However, Zamiin-Uud increased from 7.9 hr to 30.6 hr, as the rail transshipment center worked under strained capacity. A worrisome observation was that Dostyk and Altynkol still reported elevated border-crossing time in 2022 and 2023.

TFI2 (rail) reported similar levels, from $215 (2022) to $225 (2023).

- The high cost mainly accrued from gauge change operations at Dostyk and Altynkol.

- The cost of correcting documentation errors at Dostyk was considerable, indicating that such errors should be investigated by the authorities and eliminated.

TFI3 (rail) reported an increase from $804 in 2022 to $916, led by the surge in the transport rate at Corridor 4 (from $454 to $963)

- Corridor 4b was responsible for the surge in the transport rate. Rail freight was driven upward by the increase in rail tariffs to ship containerized goods between Tianjin and Ulaanbaatar.

- Containers bound for Ulaanbaatar remained stuck in Tianjin seaport for 3–4 months, causing a congestion problem. This was mentioned in Annual Report 2022, and remained unresolved in 2023, resulting in higher rail freight tariffs as import demand for container freight picked up.

- This demand, unfortunately, can be relatively inelastic. Mongolia does not have many options for cross-border trade and relies heavily on the Tianjin seaport, its gateway for both imports and exports.

SWOD declined from 53.9 km/h to 45.7 km/h in 2023, but SWD remained the same at 12.4 km/h.

- Corridor 4 was responsible for the reduced speed under SWOD, which showed a drop from 16 km/h to 10.5 km/h.

- For SWD, the corridors demonstrated similar speeds in both years.

- Relieving bottlenecks and congestion on the Tianjin to Ulaanbaatar route (Corridor 4b) is essential to increasing speeds.

Conclusion

The 2023 CPMM findings underscore the persistent importance of corridor performance monitoring in the CAREC region, especially as member countries seek to recover from recent global disruptions and strengthen regional connectivity. The analysis in this chapter highlights both the progress and the persistent challenges in cross-border trade and transport and provides two key insights. First, while average border-crossing times have improved slightly, significant disparities among corridors and modes remain. The longest delays continued to occur at specific BCPs due to procedural inefficiencies, lack of digitalization, and limited infrastructure capacity. Delays affecting container traffic, especially, reveal systemic bottlenecks in the way of seamless multimodal integration (e.g., Corridor 4b).

Second, the cost indicators present a mixed picture. Despite a general stabilization in transport and border crossing costs in 2023 compared to previous years, inflationary pressures and currency volatility still affected affordability and predictability—especially for Central Asian shippers engaged in regional trade. Road transport costs remained relatively stable, while rail costs showed a notable increase. In summary, the CPMM 2023 analysis calls for a renewed commitment from CAREC countries to prioritize trade facilitation reforms, invest in smart logistics systems, and enhance regional cooperation. Progress is evident, but sustained improvement will require both strategic investment and policy coordination. These efforts will be essential to fostering a more resilient, efficient, and competitive CAREC transport network.